colorado springs sales tax on cars

Maximum Local Sales Tax. This mandatory fee is subject to the City of Colorado Springs sales tax.

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Did South Dakota v.

. The buyer has purchased the motor vehicle within the last 36 hours from a person who is not a licensed motor vehicle dealer. When the customer returns the old starter to claim the 1000 deposit the store should refund the 1000 deposit plus the sales tax paid on the 1000. You can print a 82 sales tax table here.

If the customer trades in an old starter at the time of purchase there is no deposit collected sales tax applies only to the 3500 purchase price. That brings the total to 20580. 4045 Cherry Plum Dr Colorado Springs CO 80920.

The specific details of the new fee can be found. Sales Tax Filing and Payment Portal. The rate is 29.

Web The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. Web Colorado State Sales Tax. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax.

Use 38 Sales 39. Use 20 Sales 375. Ad Get Colorado Tax Rate By Zip.

All buyers must pay 29 of the purchase price for state sales tax. Any sale made in Colorado may also be subject to state-administered local sales taxes. Web As of July 1 2022 the State of Colorado Department of Revenue imposes a 27 cent retail delivery fee on all deliveries by motor vehicle to a location in Colorado with at least one item of tangible personal property subject to state sales or use tax.

Web Nearby homes similar to 2035 Springcrest Rd have recently sold between 525K to 653K at an average of 210 per square foot. A receipt for the state sales tax paid will be included with the vehicle title work. Free Unlimited Searches Try Now.

Maximum Possible Sales Tax. The current total local sales tax rate in Colorado Springs CO is 8200. Motor vehicle dealerships should review the DR 0100 Changes for Dealerships document in addition to the information on the DR0100 Changes web page.

Web Car Sales Tax on Private Sales in Colorado. Web In Colorado car buyers are only paying a 29 tax plus the county city and district taxes. Just enter the five-digit zip code of the location in.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Web The store must collect sales tax on 4500. Web Welcome to the City of Colorado Springs.

Web Colorado collects a 29 state sales tax rate on the purchase of all vehicles. You can review the car tax rate by state to see what other areas charge. For instance if you purchase a vehicle from a private party for 20000 then you will have to multiply that amount by 029 to get 580.

Web When a vehicle is purchased in Colorado state sales must be collected. Web What is the sales tax rate in Colorado Springs Colorado. SOLD JUN 10 2022.

The County sales tax rate is. Manitou Springs Live in Buy in. Mark McWilliams REMAX Properties Inc.

You will have to pay sales tax on any private car sales in Colorado. Fountain Live in Buy in. The Colorado Springs sales tax rate is.

City of Colorado Springs Sales Tax PO. Additional fees may be collected based on county of residence and license plate selected. Use 20 Sales 35.

630000 Last Sold Price. Web Colorado Springs CO Sales Tax Rate. The Colorado sales tax rate is currently.

The maximum tax that can be owed is 525 dollars. Box 1575 Colorado Springs CO 80901-1575. Monument Live in Buy in.

The December 2020 total local sales tax rate was 8250. Colorado state sales tax is imposed at a rate of 29. This is the total of state county and city sales tax rates.

Web The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. Web Fees are based on the empty weight and type of vehicle being registered CRS. Web For a Retail Sales Tax License make check payable to the City of Colorado Springs.

Colorado offers one of the lowest car sales taxes in the country aside from the tax-free states. City of Colorado Springs Sales Tax 30 South Nevada Avenue Ste 203 Colorado Springs CO 80903 8-5pm M-F. Tax on Rebates Dealer Incentives.

If the vehicle is purchased from a dealer in Colorado the dealer will collect the state sales tax and remit it to the state. Web 1 day agoThe sales tax would generate hundreds of millions of dollars mostly for Colorado Springs and El Paso County projects from 2025 through the end of 2034 meaning the priorities in the extension can. Tax rate information for state-administered local sales taxes is available online at TaxColoradogovhow-to-look-up-sales-use-tax-rates.

Average Local State Sales Tax. Web After Hours Purchase CRS. A buyer of a vehicle may operate a vehicle on the highway prior to registering the vehicle when.

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Taxes And Fees Department Of Revenue Motor Vehicle

How Colorado Taxes Work Auto Dealers Dealr Tax

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

Colorado Car Registration A Helpful Illustrative Guide

Colorado Bill Of Sale Forms And Registration Requirements 2020

Colorado Springs New Vehicles Chevrolet Honda Volkswagen

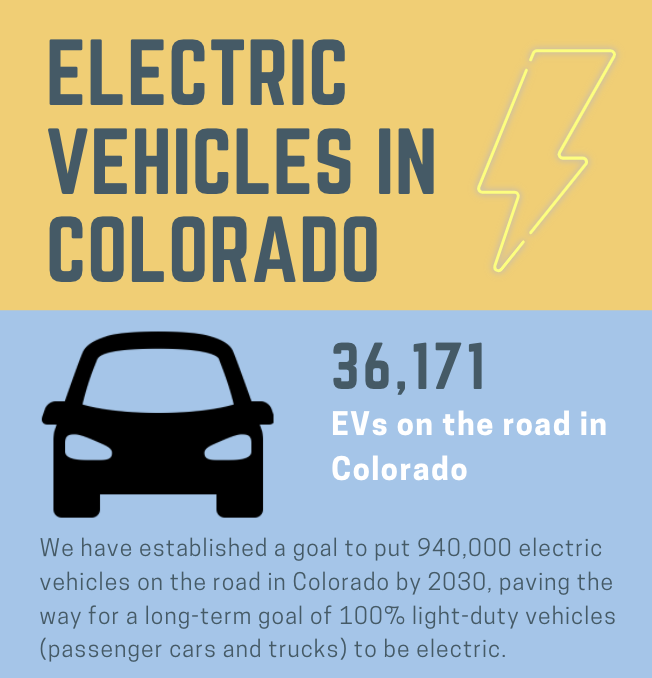

Electric Vehicles In Colorado Report May 2021

Colorado Car Registration A Helpful Illustrative Guide

Free Colorado Bill Of Sale Form Pdf Word Legaltemplates

How Colorado Taxes Work Auto Dealers Dealr Tax

How Colorado Taxes Work Auto Dealers Dealr Tax

All In The Car Dealer Family Business Gazette Com

Coloradans Bought More Vehicles Last Year Despite Limited Supply

48 Johnny Lightning 1970 Plymouth Superbird 1 24 Scale Diecast By Johnny Lightning 17 99 1970 Plymouth Superbird Lightning Cars Superbird Mattel Hot Wheels

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

700 4wd 700cc Utv In Camo Utility Vehicles Vehicles Kayak Accessories