alabama delinquent property tax phone number

801 Tom Martin Drive Birmingham AL 35211 Phone. Johns MI 48879 Phone 989224-5120 Fax 989224-5102.

Please call the assessors office in Columbiana before you send documents or if you need to schedule a meeting.

. Remember to have your propertys Tax ID Number or Parcel Number available when you call. To sign up for My Alabama Taxes MAT you will need your tax account number sign-on ID and Access Code. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Search Clinton County property records by address parcel number or owner name including comparables search property tax search and delinquent tax search. Pay price quote for State held tax delinquent property. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs the owner of or any other.

The County Collections Divisions primary function is to return tax-delinquent lands to private ownership so the revenues derived can be allocated to the appropriate counties in West Virginia. Taxes become due on October 1 and are delinquent after December 31 the same as ad valorem tax on real property. The tax rate for the Alabama Business Privilege Tax is based on how much revenue your business brings to the state of Alabama.

PUBLIC NOTICE TAX LIEN PUBLICATION. 801 Tom Martin Drive Birmingham AL. Make a Payment FAQ.

The median property tax in Montgomery County Alabama is 43500. Assessor Records Clinton County Equalization Office 100 E. So your rate will rise and fall depending on how much money your business earns each year.

If you have documents to send you can fax them to the Shelby County assessors office at 205-670-6915. Alabama tax rates range from 025 to 175 for each 1000 of your entitys Alabama net worth. Assessor Collector Delinquent Taxes and Tax Sales Chickasaw County Assessor and Collector First District 1 Pinson Square Room 3 Houston MS 38851 Phone 662456-3327 Second District 234 West Main St Okolona.

Suite 208 2020 Valleydale Rd. Search Chickasaw County property tax and appraisal records by owner name property address parcel number or PPIN through GIS maps. Section 40-10-180 of the Code of Alabama declares the tax collecting official for each county shall have the sole authority to decide whether his or her county shall utilize the sale of a tax lien for the sale of.

Montgomery County Assessor Phone Number 334 832-1250 Montgomery County Assessors Website. However delinquent personal property taxes are handled differently. Beginning January 1 when the taxes become delinquent the Revenue Commissioner must proceed to collect the taxes due or sell the property to satisfy the lien.

Hoover AL 35244 Phone. State of Alabama Sales Tax. Debit payments must be made through My Alabama Taxes.

Delinquent Property Tax List Home Facebook

Mba Delinquency By Period Mortgage Finance Blog Check And Balance

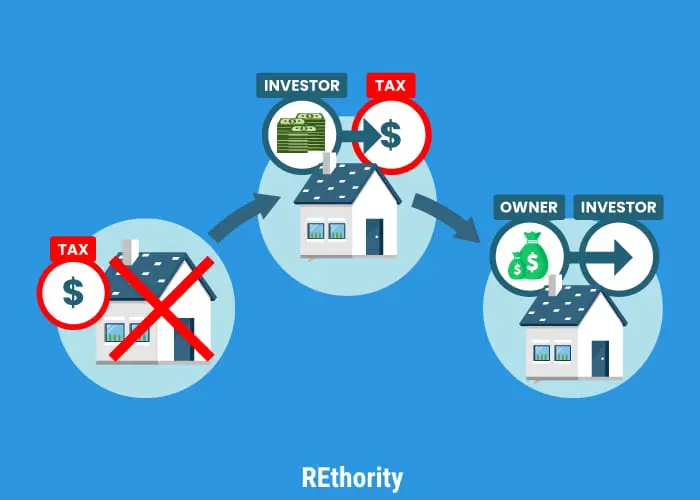

How To Find Tax Delinquent Properties In Your Area Rethority

Alabama Tax Delinquent Property Home Facebook

Sell Your House Fast In Kansas City Sellmyhousekc Com Sell Your House Fast Home Buying Selling Your House

How Is Sale Of Tax Liens For Collection Delinquent Property Tax Handled

How To Find Tax Delinquent Properties In Your Area Rethority

Alabama Tax Delinquent Property Home Facebook

Tax Delinquent Property And Land Sales Alabama Department Of Revenue In 2022 Scholarships Guidance Acting

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Jefferson County 2022 Property Valuations Protest Deadline Is July 30 2022 Burr Forman

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers